Raw Copper Block: A Comprehensive Guide to Quality Sources, Applications, and Investment Insights

I've been around the copper market long enough to know it isn't just some industrial commodity people throw into construction or electronics. No, **copper** is something far more complex. Lately, I’ve become obsessed with raw materials and how they drive global industries, and one subject that stood out is the humble raw copper block.

What Is a Raw Copper Block?

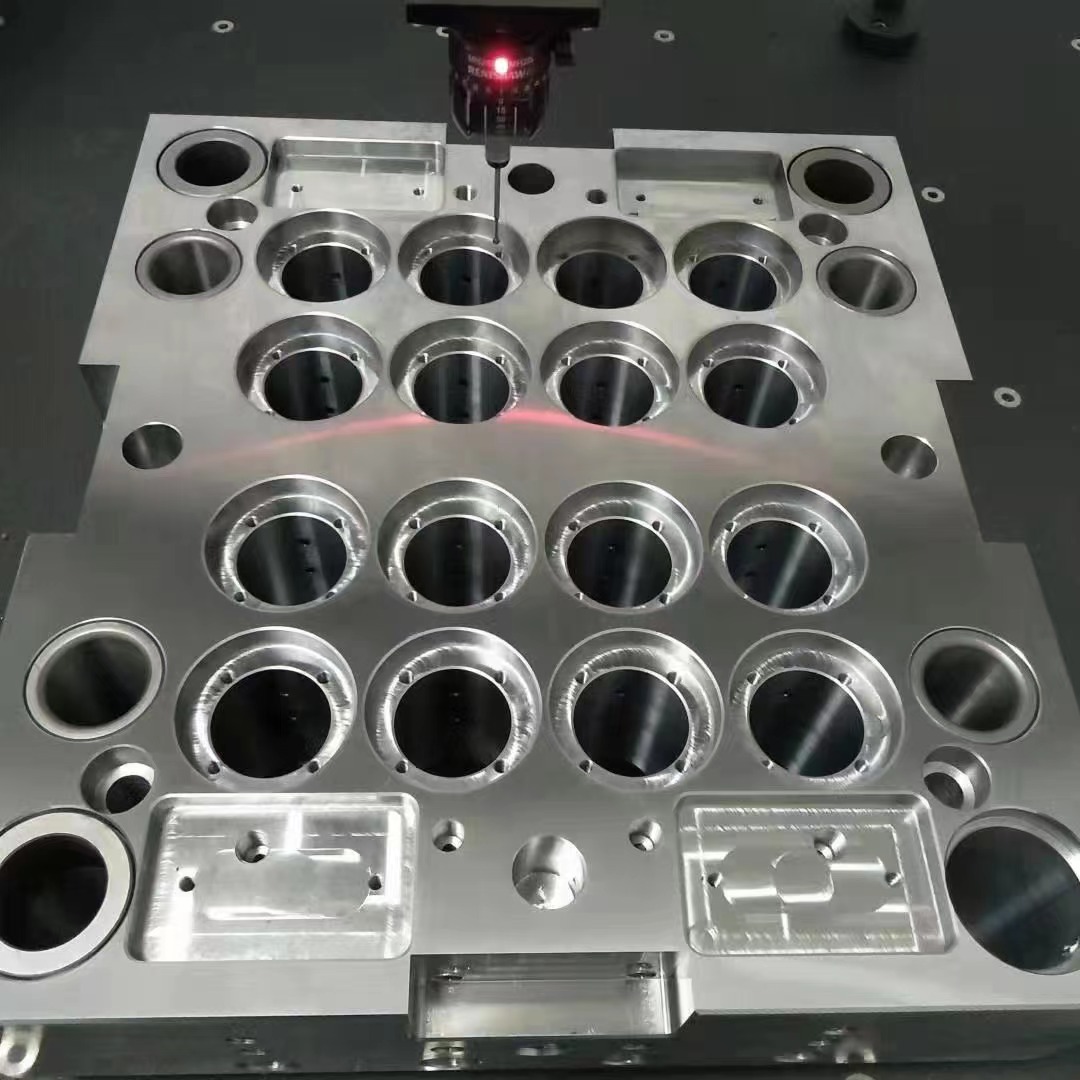

In simplest terms, a raw copper block is unrefined solid copper, often cast directly after smelting, used primarily for industrial re-processing. Unlike finished copper products like wires or coils, these blocks serve as base material for other manufacturing needs.

Where Do You Find High-Quality Source for Raw Copper Blocks?

- Larger refineries (such as Glencore or Freeport-McMoRan)

- Mining complexes in Chile and Zambia

- Regional metal trading hubs across East Asia

The supply chain here matters because not all **copper** you see on international markets comes pure. The sourcing geography determines chemical composition purity, which directly affects downstream usability in engineering and tech industries. I personally lean towards verified sources with ISO certification – no matter how expensive it seems upfront, bad source material always costs tenfold later down the road.

Common Applications of Raw Copper Block

| Industry | Application | Copper Grade Required |

|---|---|---|

| Electronics | High-conductivity circuit wiring | Bare Bright Copper or higher grade (>99.8%) |

| Construction | Pipe fittings & roofing panels | Grade C Cathode, sometimes scrap blend acceptable |

| Metal Plating | Coatings (e.g., copper plated steel for anti-friction applications) | Bare Bright or refined melt forms |

You may have noticed I slipped in "what is copper plated steel" earlier – this brings up an essential distinction between using pure raw copper and copper used to coat other metals. Plated steels typically use copper via electrolytic or immersion techniques to provide corrosion resistance and improve solderabilty in electrical parts. This ties closely back to raw copper sourcing since plating operations often begin with molten feed from processed copper cathodes.

Bare Bright Copper – What Sets It Apart?

Bare Bright Copper deserves its own section. In scrap and industrial circles, BB wire describes stripped bare, oxidization-free red copper commonly salvaged and reused after melting down for further refining. This makes it slightly cheaper than freshly sourced copper, yet surprisingly useful across sectors such as power grid development.

The real appeal lies in cost-efficiency and recyclability. My research found that in North American plants, upwards of 73% of Bare Bright Copper finds use within local wire production units — especially those making coaxial cable sheaths and data infrastructure conduits.

A note of caution though: not all sellers offering “Bright" wire are legitimate. Some include impurities or oxidation without disclosing it. If purchasing from scrapyards, request spectroscopy analysis beforehand to avoid compromising production quality. Trust me, you do not want trace zinc or lead contamination once things start moving through a press line.

Investment Considerations: Should You Trade in Raw Copper Blocks?

If we think of this practically, owning physical reserves like raw **raw copper blocks**, either as private inventory or in trade houses, requires significant infrastructure investment but comes with potential payoff under the right scenarios. Copper prices tend to be relatively stable when compared to rare earth materials, and demand has shown consistency thanks largely to electrification trends pushing into 2030 and beyond.

Sector Risks vs Market Volatility

Let's get real for a second: yes, copper will stay important but that doesn’t make your stockpile recession-proof. Here are my hard-learned points based off several portfolio crashes tied to commodities:

- Labor shortages at mines create bottlenecks that delay deliveries — and delays hurt margins if contracts were priced with fixed terms

- Transport costs rise fast, mainly due to fuel surges in global truck routes. Stacking inventory overseas? Get ready for price hikes

- Different nations slap export duties at short notice, particularly African nations looking to boost their own processing capacities — I’m eyeing Katanga and Kolwezi policies right now

To hedge some risks, savvy investors layer exposure. One strategy involves pairing futures instruments alongside physical ownership while hedging against dollar value movements by investing in currency derivatives. Not foolproof by any means, but diversifying risk beats losing six-figures worth of ingots over logistical chaos.

Conclusion

This exploration started out purely for personal knowledge-building, and what emerged turned into a deeper-than-anticipated journey across copper sourcing realities, its industrial applications, financial implications, and why even terminology like ‘bare bright copper’ holds serious weight in procurement chains worldwide. For professionals who depend on raw copper blocks—be it manufacturing, recycling, investment—I recommend maintaining direct oversight from ore extraction up through casting facilities rather than relying solely on spot purchases off platforms or intermediaries alone.

To wrap up my experience so far — copper remains both foundational and fragile. Handling the right blocks takes effort, planning, and vigilance—but when done well? It’s still the core behind most of modern civilization. As long I'm building and investing with precision tools in hand, there’s no turning away from copper.

If anything, my journey with raw copper blocks just started — there's still too much untapped value, complexity to unravel, and opportunity to ignore, especially given where global technology and policy seem to be headed these days. One slab at a time.